Last week The Plan Sponsor University (TPSU) held a Fiduciary Education Program at Florida Atlantic University (FAU) where attendees could earn Continuing Education credits in Retirement Administration from SHRM and HRCI by attending. Approximately 30 companies sent representatives to participate in the Program which ran from 8:00am to 2:00pm on Wednesday, April 5th. There were many different reasons why attendees chose to attend last week but there was uniformity in what the attendees experienced.

Why Fiduciaries Chose to Attend

The reasons plan participants decided to attend the program were collected at during the start of the program and the list included:

- to learn about auto-escalation;

- to learn if our company has the correct retirement plan advisor;

- to obtain Continuing Education credit related to fiduciary education this year; and

- to find a way to have a larger percentage of our employees participate in our 401(k) or 403(b) plan.

Improving Plan Participation Rates

Wanting to improve plan participation rates is not unique to the attendees at FAU. The Economic Policy Institute’s Retirement Inequality Chartbook, published as The State of American Retirement identifies how 401(k)s have failed to provide for many Americans.

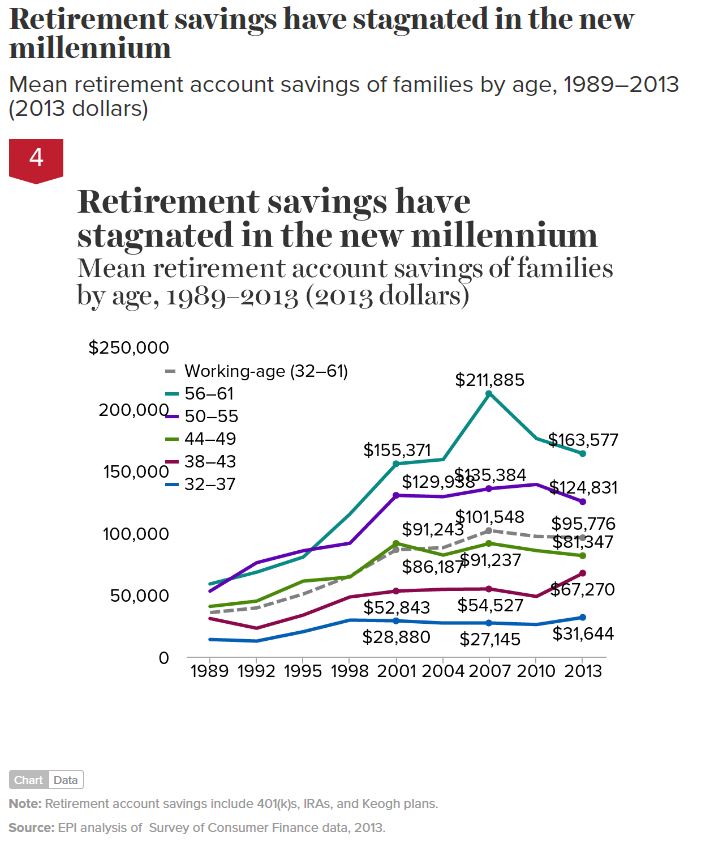

The average retirement account grew between 2001 and 2013 however this was due primarily to the aging of the large baby boomer cohort. Absent that fact, there was stagnation among the non-baby boomer age group.

The Huffington Post recently reported that almost half of all U.S. households do not have any retirement savings, and among families age 32 to 61 who do have retirement savings, the median balance is about $60,00.00.

For working Americans choosing not to participate in their company retirement plan; the cost of funding their retirement will likely fall squarely on the shoulders of other working Americans. Plan Sponsor fiduciaries at the TPSU Continuing Education Program at FAU learned of different techniques and Plan Design options which can have a positive impact on the savings rates and ultimate savings overall of 401(k) plan participants.