Though target date funds (TDFs) have helped investors in defined contribution (DC) plans like 401(k)s and 403(b)s stay invested in the market and achieve better returns, many are still misusing them according to a Aon Hewitt study. Though TDFs are designed to manage all of the money within a participant’s DC plan, less than 70% allocate correctly.

The problem? Language and misperception according to a DC money manager which studies the use or misuse of language in the DC industry. After hammering home that investors should not put all their money in one basket, we are now telling them to put all their assets in TDFs. In a study, 63% of investors were likely to allocate all of their DC assets when the form described what the TDF does while only 24% of investors were likely to do the same when the description only included what it is.

For all but a few savvy investors, it makes no sense for investors to only allocate a portion of their DC assets into a TDF. By allocating money in other investments, the participants is overriding asset allocation or glide path decisions by seasoned professionals – if they knew what they meant – which needs to be constantly readjusted.

Some behavioral economists suggest that choice architecture may be even more effective than listing what the TDF does rather than what it is. They suggest that the first screen for investment section should ask whether the participant wants to have a professional manage their money through a TDF. If yes, then all assets are allocated accordingly. If no, then the plan’s investment choices are listed and the participant makes their asset allocation decisions. Some believe that TDFs should not be an option when participants are self-allocating.

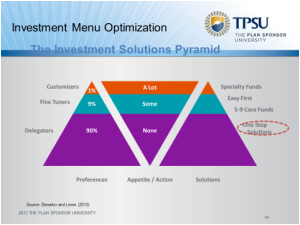

UCLA Professor Shlomo Benartzi and noted behavior economist suggests in his seminal book, “Save More Tomorrow”, that 90% of participants want someone else to manage their money (see chart below). Setting up the right choice architecture might achieve that result.