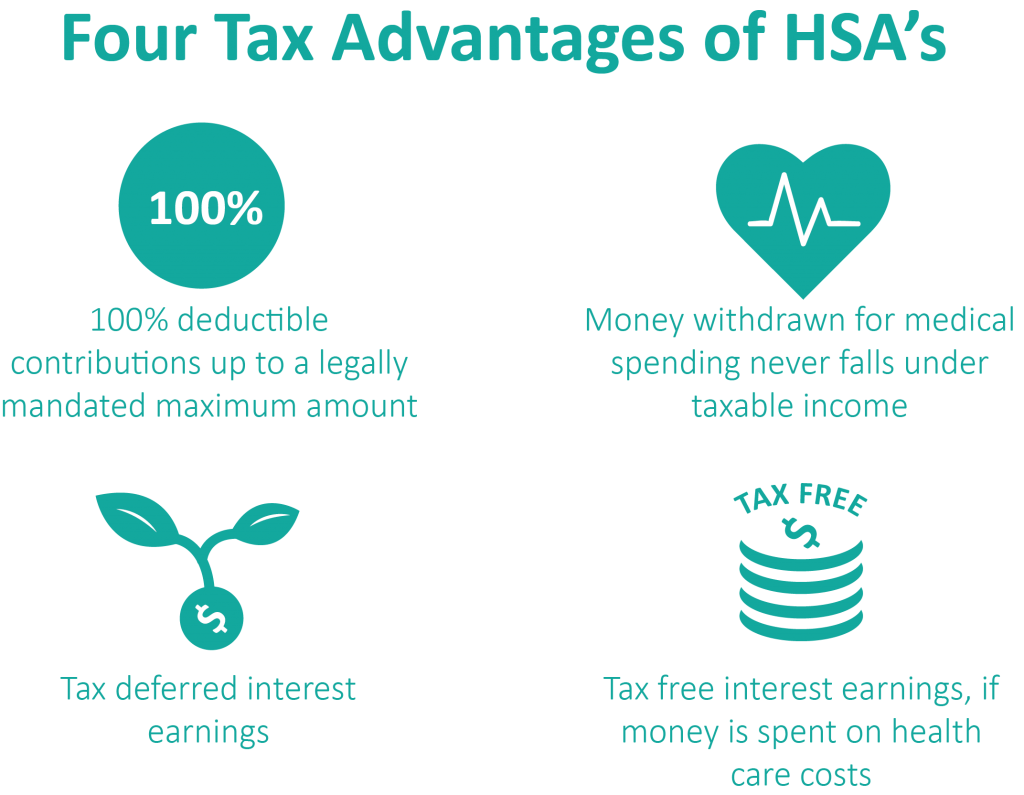

If your company does not offer a health savings account (HSA), you are missing out on a great benefit that can cost the company nothing while offering a savings account with triple tax benefits.

With the advent of high deductible healthcare plans, which have become the second most popular health care option and is expected to grow exponentially, many employees offer an HSA which can be used to pay the premiums as well as other qualified medical expenses. The annual limits for contributions, are tax free going into and coming out of the HSA as well as their growth, include:

- $3350 for a single person

- $6750 for a family

- $1000 extra for people 55 or older

People are allowed a one-time transfer from their IRA which cannot exceed these limits.

If the spouse is the beneficiary, the HSA can be used by them when a person dies; if not, the beneficiary gets the money after taxes are paid. Many people make the mistake of putting the HSA assets into a bank account with low interest rates but they can invest in mutual funds just like their 401k plan.

Which raise the important question: “are all HSAs are the same?” The answer, obviously, is not so either the employer can choose the HSA provider for all employees or allow the employees to make the choice themselves. And, of course, fees matter so reviewing and comparing them is very important. An independent service AccessPointHSA is available to advisors and employees to help with this process.

There is a convergence of benefits happening with some firms like MassMutual offering private exchanges including healthcare and retirement benefits. Allowing people to manage their benefits depending on their needs or family situation is becoming easier through new tools helping to create a benefits budget. With some thought and a bit of work but not much if any additional expenses, an employer can maximize their benefits budget to recruit, retain and help their workers.